Define Depreciation in Accounting

The transaction type in Asset Accounting classifies the business transaction. Disposal of Fixed Assets.

Ch 12 Definition Of Depreciation Question What Is Depreciation Answers Depreciation Is An Example Of The Matching Principle In Action It Represents Ppt Download

We define a credit card payment as the amount a company remits to the credit card company for the purchases that occurred by using the credit card.

. For depreciation area 1 system posts value in real time whereas for depreciation area 30 system posts only depreciation value. Define Net Book Value. Specify Transfer of Depreciation Terms.

Define Depreciation Area for Quantity Update. Net Book Value 540000. The intent is to.

Copying assets from within a company or from one company to another. How to Define Business Area in SAP Business area in SAP is an organizational unit within accounting that can be classified as geographical wise or product wise as per the requirements of an organization. Importantly you may use more than one depreciation area to represent different asset valuations.

Determine Depreciation Areas in the. What is a credit memo. In accounting the amortization of intangible assets refers to distributing the cost of an intangible asset over time.

This is for cost accounting or legal reporting. The depreciation rate can also be calculated as the reciprocal of the useful life Useful Life Useful life is the estimated time period for which the asset is expected to be functional and can be. Define depreciation area 1 book depreciation area and 30 depreciation area for Indian GAAP.

Accounting Explained in 100 Pages or Less. Specify Transfer of APC Values. The transaction type controls various system activities when business transactions are posted.

It is denoted by a two-digit key. Click on Define Depreciation Areas and put the COD and create-b. The Construction Accounting course addresses every aspect of the accounting for a construction business.

Accumulated depreciation is a negative asset account referred by accounting professionals as a contra-asset account used to capture depreciation and reduce the value of the fixed asset without altering the initial value recorded on the books under the furniture and equipment account. The Construction Accounting course addresses every aspect of the accounting for a construction business. Define the three components of the Accounting Equation.

If you are making a prior period adjustment to an interim period of the current accounting year restate the interim period to reflect the impact of the adjustment. The intent is to not only explain accounting concepts but also provide examples and show how an accounting system can be constructed and operated. Asset Accounting in SAP FI-AA is used for managing and supervising the fixed assets of an organization.

Calculations and limitation of all listed property and luxury auto. SPRO IMG Financial accounting new Asset Accounting Depreciation Valuation Methods Depreciation Key Maintain depreciation key. Use following menu path or transaction code.

The definition of business area in SAP is optional. A depreciation area in SAP FICO Asset Accounting contains the parameters you require to value an asset. Example of a Credit Memo.

Project depreciation through the life of an asset. Definition of Credit Memo. Period - The estimated useful life span or life expectancy of an asset.

How to Define Depreciation Area in Asset Accounting SAP FICO. The companys payment to the credit card company will result in a credit to the companys Cash account. Under business area you generate financial statements of balance sheet and profit loss account for internal reporting.

Automatic calculation of tax preference amounts prior-year depreciation and gains and losses on asset sales. Next determine the depreciation rate category based on the propertys natureIt would be either 5 10 or 100 which would be used to calculate the annual depreciation of the building. However the debit portion of the payment entry depends on whether the individual credit card purchases had been previously.

These sample problems are intended as a supplement to my book Accounting Made Simple. Depreciation represents the cost of capital assets on the balance sheet being used over time and amortization is the similar cost of using intangible assets like goodwill over time. Put the COD of yours do the configuration-D.

Enter chart of depreciation key and press enter to continue. Accumulated Depreciation as of 12312016 60000. The main purpose of asset accounting is to extract the exact values of the fixed.

One type of credit memo is issued by a seller in order to reduce the amount that a customer owes from a previously issued sales invoiceAnother type of credit memo or credit memorandum is issued by a bank when it increases a depositors checking account for a certain transaction. Final value residual value - The expected final market value after the useful life of the asset. Asset value - The original value of the asset for which you are calculating depreciation.

Below is the explanation of the values that are required to add to the calculator for calculation. Maintain Depreciation Key in SAP. If a business owns a piece of real estate worth 250000 and they owe 180000 on a loan for that real estate what is.

Define Depreciation Areas. Finally when you record a prior period adjustment disclose the effect of the correction on each financial statement line item and any affected per-share amounts as well as the cumulative effect on. NPV means the carrying value of an asset derived by reducing the purchase cost by the accumulated depreciation.

What is Asset Accounting in SAP SAP Asset Accounting is also called as sub ledger accounting it is one of the important sub-module of SAP financial accounting SAP FICO module. Access the transaction by using the following navigation option. The object that classifies the business transaction for example acquisition retirement or transfer and determines how the transaction is processed in the.

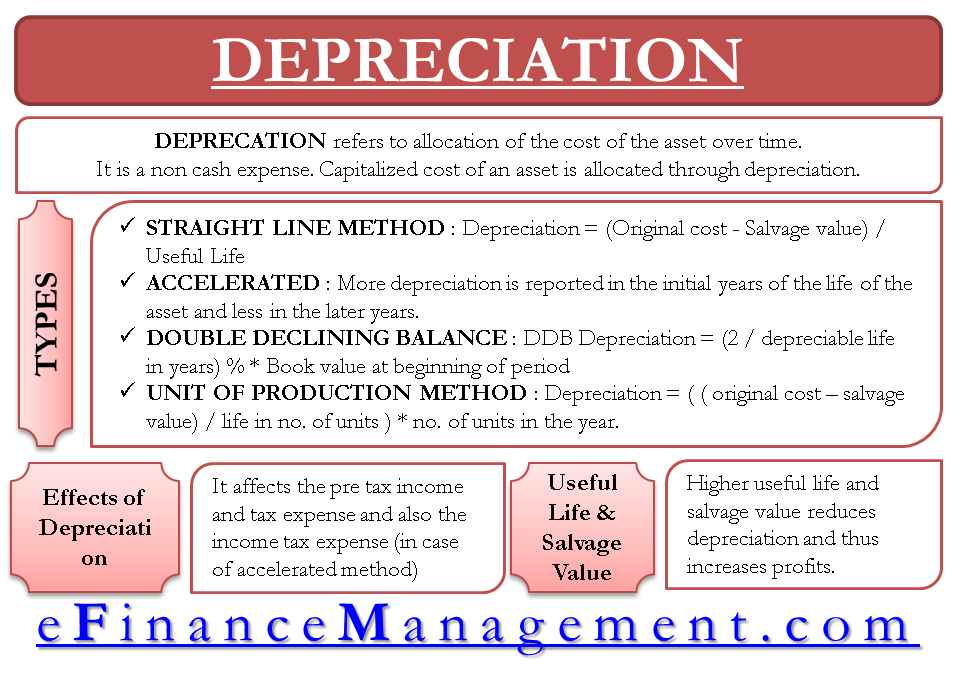

Depreciation Definition Types Of Its Methods With Impact On Net Income

Depreciation Meaning Types Of Depreciation Examples Units Of Production Commerce Achiever Commerce Achiever

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Comments

Post a Comment